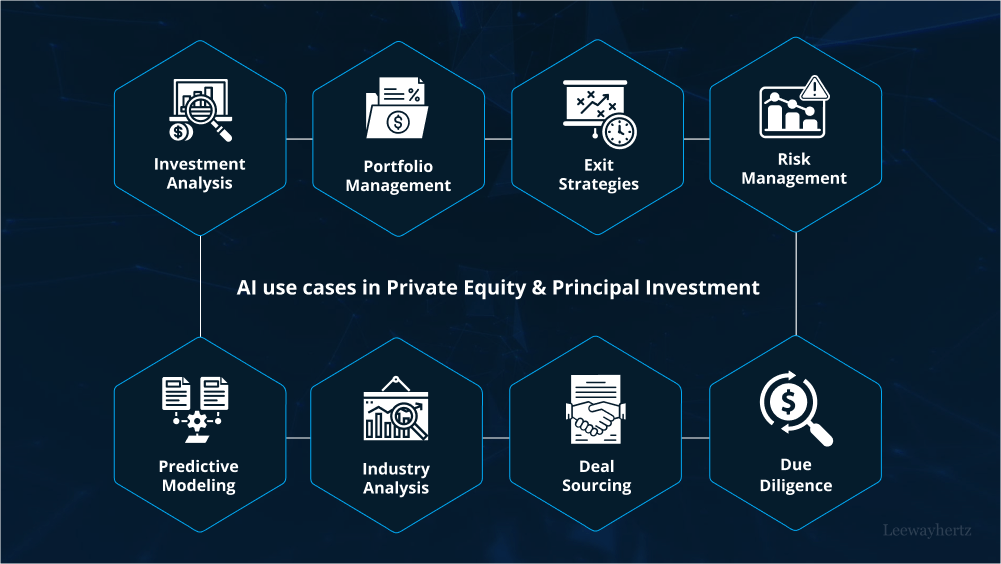

Artificial Intelligence (AI) has become a transformative force across various industries, and private equity and principal investment are no exception. In recent years, AI has gained prominence in these financial sectors, revolutionizing how deals are sourced, evaluated, and managed. The integration of AI technologies has brought increased efficiency, improved decision-making, and enhanced portfolio management. Here are some key AI use cases and applications in private equity and principal investment:

- Deal Sourcing and Origination:

AI-powered algorithms can analyze vast amounts of data from multiple sources, including news articles, social media, and financial databases, to identify potential investment opportunities. By applying natural language processing (NLP) and machine learning techniques, private equity firms can discover relevant signals and trends that might otherwise remain hidden, expanding their deal flow and ensuring they stay ahead of the competition.

- Due Diligence:

Conducting due diligence is a critical phase in the investment process. AI can streamline this procedure by automating the analysis of financial statements, legal documents, and other crucial data. Sentiment analysis can be applied to gauge public perception and customer sentiments regarding the target company, offering valuable insights that aid in making informed investment decisions. - Valuation and Pricing:

Determining the accurate value of a target company is paramount. AI-driven models can predict valuation scenarios based on historical data, market trends, and macroeconomic factors. These models can also optimize pricing strategies during negotiations, ensuring that investors strike deals that align with their investment objectives. - Risk Assessment and Mitigation:

AI can enhance risk management by identifying potential risks and predicting their impact on investments. By analyzing historical data and market patterns, AI algorithms can assess risk exposure and propose risk mitigation strategies. Additionally, AI-driven monitoring systems can continuously track portfolio companies, providing real-time alerts on potential issues, enabling swift action to protect investments. - Market and Competitive Analysis:

AI tools offer invaluable insights into market dynamics and competitor behaviors. Investors can leverage AI to monitor industry trends, track competitor activities, and understand customer preferences, leading to more informed investment strategies and proactive portfolio management. - Portfolio Optimization:

AI algorithms can optimize investment portfolios by considering risk-return trade-offs and aligning with investors’ risk preferences. These models can continuously rebalance portfolios, ensuring optimal asset allocation and maximizing returns in dynamic market conditions. - Predictive Analytics:

AI’s predictive capabilities empower private equity firms to anticipate market movements and make strategic decisions accordingly. Machine learning models can forecast investment performance, exit opportunities, and potential disruptions, guiding investors to allocate resources efficiently. - Operational Efficiency:

AI can streamline internal processes and enhance operational efficiency within private equity firms. From automating routine tasks to optimizing workflow, AI-driven solutions can free up valuable resources and reduce operational costs, allowing professionals to focus on more strategic activities. - Enhanced Investor Relations:

AI-powered chatbots and virtual assistants can improve investor relations by providing real-time updates, answering queries, and offering personalized insights to individual investors. This enhanced communication fosters stronger relationships and boosts investor confidence. - Post-Investment Monitoring:

AI tools enable continuous monitoring of portfolio companies’ performance and financial health. Through real-time data analysis, investors can identify early warning signs and take corrective actions promptly, ensuring the success of their investments.

In conclusion, AI has rapidly transformed the landscape of private equity and principal investment. From deal sourcing to portfolio management, AI applications have revolutionized traditional investment practices, enabling more data-driven and informed decision-making. As the technology continues to advance, private equity firms and principal investors must embrace AI to remain competitive in the ever-evolving financial markets. However, it is essential to strike a balance between AI-driven insights and human expertise, as the fusion of both will yield the most fruitful results for these sectors in the future.

To Learn More:- https://www.leewayhertz.com/ai-use-cases-in-private-equity-and-principal-investment/