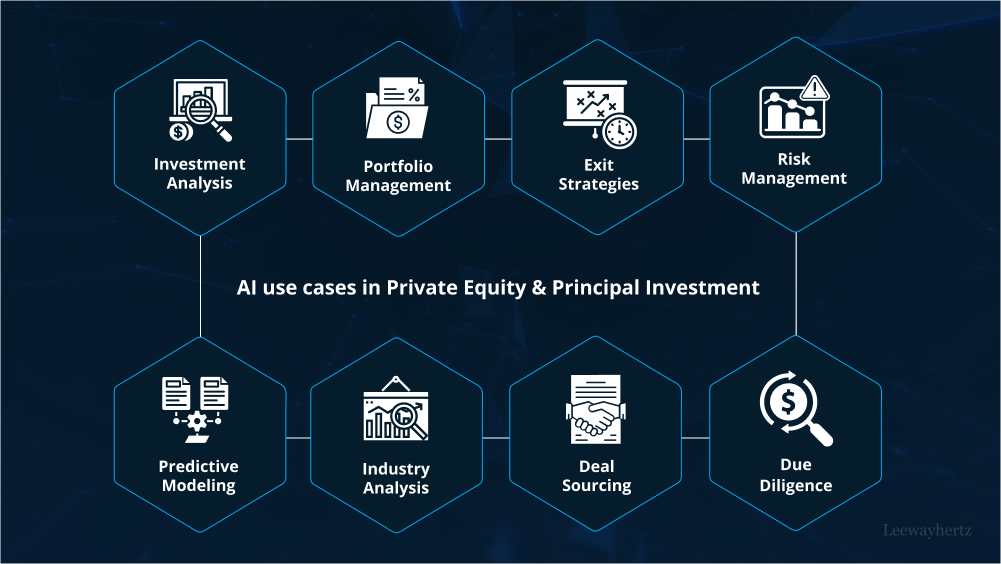

Artificial Intelligence (AI) has made significant strides across industries, transforming the way businesses operate and make decisions. In the realm of finance, particularly in the domains of private equity and principal investment, AI is proving to be a game-changer. Private equity firms and principal investors are leveraging AI technologies to enhance their investment strategies, optimize decision-making processes, and uncover valuable insights from vast amounts of data. This article explores some of the compelling AI use cases in these sectors.

Data-driven Investment Decisions

Private equity and principal investment involve complex decision-making processes that require a deep understanding of market trends, company performance, and financial data. AI-powered analytics tools are assisting investors in making informed decisions by processing and analyzing large datasets more efficiently than traditional methods. Machine learning algorithms can uncover patterns, correlations, and trends in data that might be too intricate for human analysts to discern.

Predictive Analytics for Due Diligence

One of the critical stages in private equity is due diligence, where potential investment targets undergo thorough scrutiny. AI models can aid in this process by predicting the future performance of a company based on historical data and relevant market indicators. By analyzing a company’s financials, industry trends, and even social sentiment, AI can provide insights into potential risks and growth opportunities, helping investors make more accurate predictions about the success of an investment.

Risk Management and Fraud Detection

AI’s ability to process vast amounts of data in real-time is invaluable when it comes to risk management and fraud detection. Private equity firms can use AI algorithms to assess the financial health of portfolio companies continuously. Any anomalies or deviations from expected financial patterns can trigger alerts, enabling investors to take proactive measures to mitigate risks. Furthermore, AI can help identify fraudulent activities by analyzing transaction patterns and flagging suspicious behavior.

Automated Deal Sourcing

Traditionally, deal sourcing has been a time-consuming task that requires extensive networking and research. AI-powered algorithms can automate this process by scanning a multitude of sources, such as news articles, company websites, and regulatory filings, to identify potential investment opportunities. By using natural language processing and sentiment analysis, AI can prioritize opportunities that align with an investor’s preferences and strategies.

Portfolio Optimization

Maintaining a well-balanced portfolio is crucial for successful private equity and principal investment. AI can assist in optimizing portfolios by using advanced algorithms to assess various factors, including risk tolerance, expected returns, and market conditions. These algorithms can suggest adjustments to a portfolio’s composition to ensure that it aligns with the investor’s goals and adapts to changing market dynamics.

Enhancing Deal Structuring

AI technologies are also enhancing the process of structuring investment deals. By analyzing historical deal data, AI can provide insights into optimal deal structures based on the characteristics of the target company, industry trends, and the investor’s objectives. This can result in more favorable terms for both the investor and the target company, leading to better outcomes for all parties involved.

Conclusion

The integration of AI into private equity and principal investment is revolutionizing the way these sectors operate. From data-driven decision-making and predictive analytics to risk management and portfolio optimization, AI offers a wide range of use cases that empower investors to make more informed and strategic choices. While AI can never replace the expertise and intuition of seasoned investors, it complements their abilities by processing vast amounts of data quickly and uncovering insights that may otherwise remain hidden. As AI continues to evolve, its role in shaping the future of finance, particularly in private equity and principal investment, will only become more pronounced. Embracing these technologies can provide a competitive edge and drive better outcomes for investors in an increasingly dynamic and complex financial landscape.

To Learn More:- https://www.leewayhertz.com/ai-use-cases-in-private-equity-and-principal-investment/